Income Tax Refund Loan using a Smart Phone, Tablet or Computer

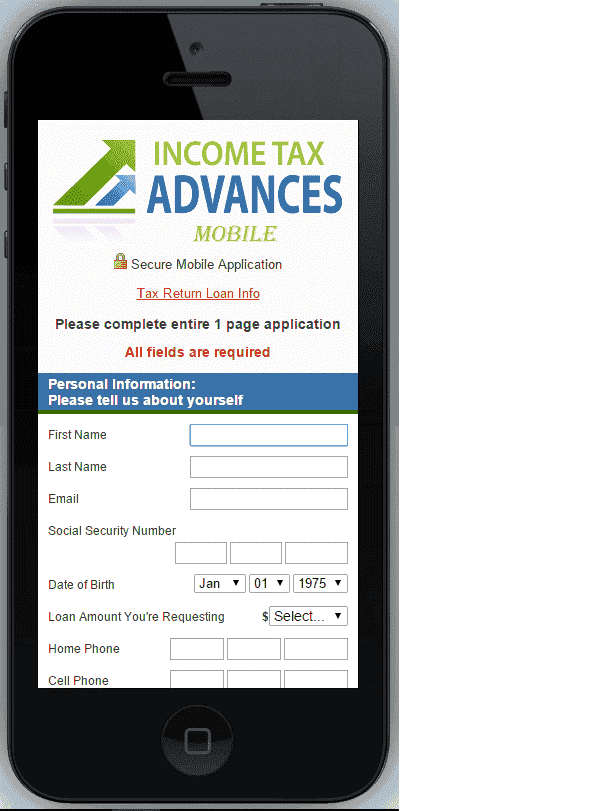

You need nothing more then a smart phone, tablet or computer and you can easily apply for an Income Tax Refund Loan. For our mobile customers, we have a Mobile Application developed to help mobile customers get the loan they need with or without a computer.

An 'Income Tax Refund Loan' is a loan provided through a third party like IncomeTaxAdvances.com and is secured against a taxpayer's expected refund or current income.

Income tax refund loans, while not provided by the U.S. Treasury or the IRS, are therefore subject to interest and fees which are set by the lender but based on the laws of each state.

What information Is Needed to Qualify for an Income Tax Refund Loan?

IncomeTaxAdvances.com’s Income Tax Refund Loans are backed by your anticipated tax return *. Because your anticipated tax return is your "insurance" on the loan, we need very little from you. As long as you expect money back from the IRS, you have a job, and you get paid at least $800 every month, you can qualify for one of IncomeTaxAdvances.com’s Income Tax Refund Loans.

I have no credit. Should I Apply for an Income Tax Refund Loan?

Yes! Our lenders don’t perform credit checks with the 3 major credit bureaus. So, bad credit or no credit is okay too!

"I just filed my taxes. The IRS says they’ll take up to 21 days or more to return me my money! How much faster can IncomeTaxAdvances.com do it?"

Much faster than that! Once you fill out our 3 minute application you’ll receive an approval notification within 90 second and you can have your income tax money in less than 24 hours. That’s at the very least 20 days sooner than the IRS can provide it!

I haven’t filed my taxes yet. Can I still get an Income Tax Refund Loan?

Of course, at IncomeTaxAdvances.com, we don’t require you to have filed your tax return before you apply for our online Income Tax Refund Loan. We DO recommend that you file your taxes soon after, because most Income Tax Refund Loans are due to be repaid within a couple weeks after funds are distributed.

Will IncomeTaxAdvances.com file my taxes for me?

No, we can’t file or prepare taxes for you. However, Free Tax USA, the leading online tax preparation company in the nation, is one of our trusted partners. IncomeTaxAdvances.com is providing our website’s visitors and customers access to FREE tax filing. It’s easy, fast, AND FREE! Click here to get started: Do it right. Do it for free.![]() !

!

I’m ready to apply for an Income Tax Refund Loan so what do I do now?

Fill out IncomeTaxAdvances.com’s easy-to-use mobile application. You’ll know if you quality 90 seconds from the time you submit your application. You can expect your money in your bank account within one business day! Our lenders are waiting to assist you, now!

*While our Tax Refund Loans are backed by your income tax refund, we must base your approval off your current income and place your repayment date on your pay date. This allows us to not ask for copies of your income tax returns and ensure your loan will be repaid on time, even if the IRS keeps your refund.

- Safe & Secure Process

- Approval in Minutes

- No Obligation Application

- No Office Visits - 100% Online

Mulitple Lenders

Await Your Request

Secure & Private Service

Income Tax Advances is an online lender that provides safe and secure refund anticipation loans to consumers who have their paycheck direct deposited into a checking or savings account. Since we base your refund anticipation loan off your income you are never required to supply a copy of your income tax return and you can apply even before you file your taxes and you can apply right here online. We collect information about your bank account details, as well as employment details, and we keep all data confidential. We only use it to process your online income tax loan. Your information is always safe when you apply for Income Tax Advances Online.

Through encryption and high levels of data security, we protect you and we keep your information safe. Our systems have been developed to guard against identity theft. We understand how valuable your personal details are: your social security number, bank account number, address and phone numbers, etc.

Loan Terms: Income Tax Advances works with many lenders and does it's very best to match you with the lender with the best loan terms based on the information you provide on the application. All repayment terms are provided by the lender and therefore all questions concerning loan terms should be addressed directly with the lender you are matched with. For more information simply click on "Rates and Fees" located at the bottom of every page.

Tax Filing: Income Tax Advances or its lenders do not file your taxes for you, do not receive your tax refund directly and do not request copies of your tax returns. Due to the potential of the IRS either keeping or delaying your tax refund we must place the repayment of the loan to be due on one of your pay dates for your protection. Further, since we do not file your taxes or know for certain the amount you will be refunded from the IRS, we must base your Refund Anticipation Loan amount on your income and cap the maximum loan amount at $1500.

Bank Account Required: In order to receive a loan you must have a bank account where the Refund Anticipation Loan can be deposited and repayment drawn from. In most cases the loan will be direct deposited into your bank account within 1 business day and repayment will be auto drafted from the same bank account. We want you to be aware of this so you deposit enough of your refund into your bank account to cover the loan and fees. If you wish to request to renew, extend or refinance your loan then you must contact the lender who will be there to assist you. A loan renewal, extension or refinance will most likely result in additional fees, charges or interest which you should discuss with your lender.

Income Tax Advances provides online refund anticipation loan services of one type or another in almost all 50 states. However, some states only allow for issuing of refund installment loans or refund lines of credit.

All Income Tax Advance lenders act as a credit service organization or credit access businesses (CSO/CAB) in Texas and are not the lender - loans there are made by third-party lenders in accordance with Texas Law.

This is an invitation to submit a refund anticipation loan application, not an offer to make a refund anticipation loan. No person applying is guaranteed to receive either a refund anticipation loan, tax refund loan in 1 hour, tax refund installment loan or tax refund line of credit.